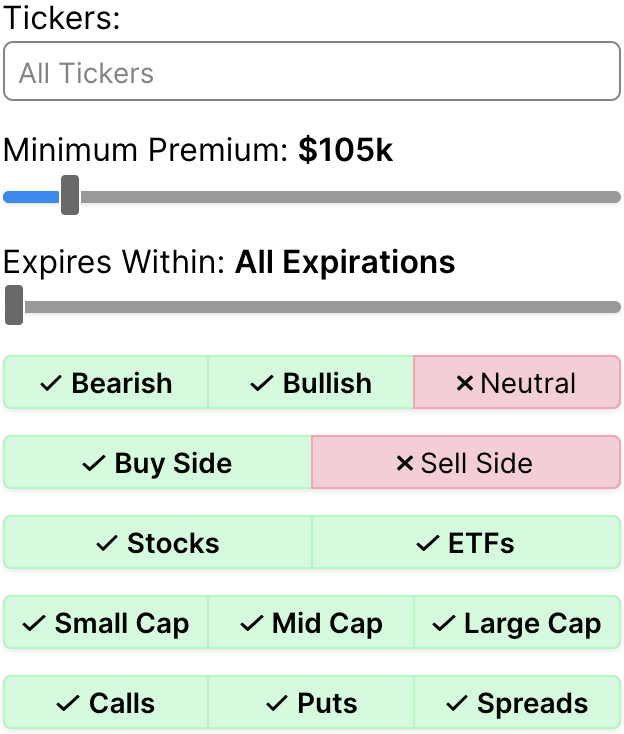

In addition, if you choose the advanced scenario you'll find a few more fields: Note that to find dollar gain, you'll want to subtract your cost of exercise. Net / Gain: the net dollars you'll have in your pocket at sale followed by the gain you made net of your share purchase (in percent).Total Tax: the total capital gains and income tax you pay in either scenario.Cash to Exercise: the cost it will take for you to buy the shares granted to you by the option, including any applicable income tax.In the base scenario, you'll find 3 outputs Short-term capital gains apply to investments held under a year – that column will show the cost to selling early (or, alternatively, if you're an optimist, the benefit to waiting!) Simple Calculation

Note that you'll get two answers based on whether you hold exercised shares for more than a year or less than a year for both views. an advanced view which also shows capital gains and income breakdown.a simplified view that summarizes a scenario's cost to exercise, total taxes, and returns.Long Term Capital Gains Tax Rate (%): your marginal tax rate (including any state and local addition) on investments held for more than a year.Short Term Capital Gains Tax Rate (%): your marginal tax rate (including any state and local addition) on investments held for less than a year.Marginal Tax Rate (%): your tax rate on income at the margin, including any Federal, State, or Local taxes (include payroll tax as well, if applicable).Sale Price: the price to sell the exercised shares.Exercise FMV or Assessment/409A: either the market price at exercise or the price per share from an independent assessment (generally a 409A for a private company).Options strike price: the strike price of your options grant.Number of options: how many shares you have the option to purchase.

Stock profit calculator options full#

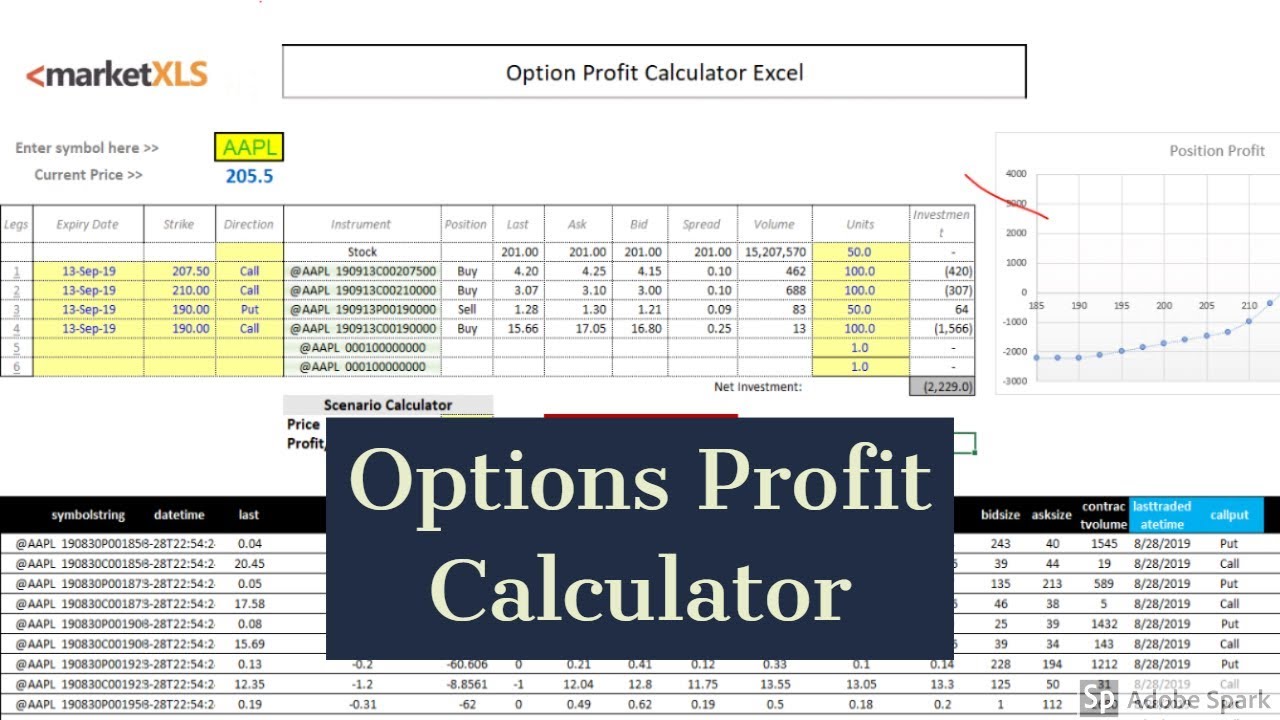

Non-qualified Stock Option Inputsīefore you can use the tool to its full potential, you'll have to gather some data – and make some guesses at tax rates. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

NSOs (as they are abbreviated) are available to everyone from employees to investors to advisors (and more) and – while complicated – have a straightforward taxation scheme. In the United States, non-qualified stock options are stock options defined by a negative – they don't qualify for the special treatment for incentive stock options. 4 Non-Qualified Stock Options: Way Better than a Lottery Ticket Using the NSO Calculator

0 kommentar(er)

0 kommentar(er)